Table Of Content

He was also a writer for the BBC for three years and marketing manager for two non-profits. Pittsburgh was found to be the most affordable city for home buyers. Mortgage lenders had a bumper year in 2021 and could hardly keep up with demand. And that means many companies are more willing to work for your business. There are more than 2,000 down payment assistance programs (DPAs) across the country.

Understand Your Mortgage Options

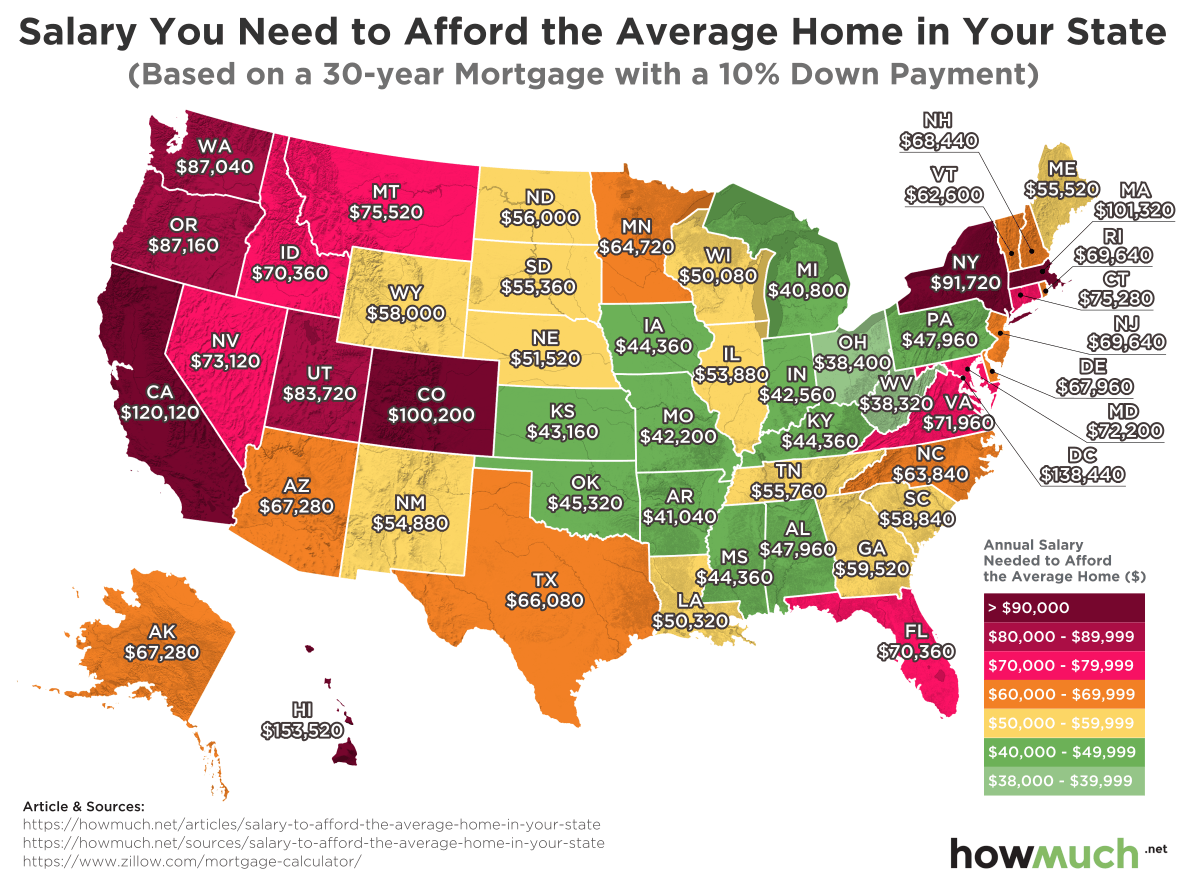

In order to comfortably afford a median-priced home, a first-time buyer paying 10% down with a mortgage rate of 7.2% (the current 30-year mortgage rate) needs to earn an income of $119,769 annually. As the cost of homebuying climbs, first-time buyers need a six-figure salary to purchase the average home. Research released Monday from real estate company Clever finds that with a 10% down payment, buyers need to earn nearly $120,000 to afford a median-priced home. Experts often recommend would-be buyers put down at least 20% when purchasing a home to lower monthly payments and avoid paying extra for private mortgage insurance. Both these loan programs allow just 3% down payment and have reduced private mortgage insurance (PMI) costs.

Using the 36% Rule

If your mortgage loan is backed by the Federal Housing Administration (FHA), you’ll have the added expense of up-front mortgage insurance and monthly mortgage insurance premiums. Even a small difference in interest rate could mean a difference of hundreds or even thousands of dollars in interest you’ll pay over the life of the loan. Interest rates also affect the size of your monthly payment, which has the most direct impact on affordability. Let’s say you still take out the $200,000 loan with a 5% interest rate, but the term is 30 years.

How to Save a Down Payment While Renting

Eligible buyers should also check out the Department of Housing and Urban Development (HUD)’s Good Neighbor Next Door Program. This offers a discount of 50% off the list price of a home to law enforcement officers, teachers (pre-Kindergarten through 12th grade), firefighters, and emergency medical technicians. “In return, an eligible buyer must commit to live in the property for 36 months as his/her principal residence.” The catch? The home must be in a designated revitalization area, which may not currently be a desirable neighborhood. And, finally, you could always ask a relative to contribute to your closing costs if you know someone who would be willing to help out.

What factors determine how much you can afford?

The longer you can stay in a home, the easier it is to justify the expenses of closing costs and moving all your belongings — and the more equity you’ll be able to build. Additionally, 37% are worried about meeting basic living costs such as food and housing. Looking beyond the world of starter homes, affordability gets even higher for the average buyer. Americans must earn roughly $106,500 to comfortably afford a typical home, according to research last month from digital real estate company Zillow. The typical starter home sold for $240,000 in February, up 3.4% from the prior year, according to Redfin. In February of 2020, the median sale price for such homes was $169,000, while the average mortgage rate hovered around 3.5%.

You’re our first priority.Every time.

In these 22 states, you need a six-figure income to afford a typical home, analysis finds - CNN

In these 22 states, you need a six-figure income to afford a typical home, analysis finds.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

The mortgage interest rate is the amount charged by a lender in exchange for loaning money to a buyer. It is expressed as a yearly percentage of the total loan amount but is calculated into the monthly mortgage payment. If your down payment is less than 20 percent of your home's purchase price, you may need to pay for mortgage insurance.

Here is how much household income you’ll need to afford the median-priced home in every US state - CNN

Here is how much household income you’ll need to afford the median-priced home in every US state.

Posted: Mon, 01 Apr 2024 07:00:00 GMT [source]

The idea here is to see accomplishments as they happen so you build confidence and momentum that you can afford homeownership. One way to protect yourself is to ask plenty of question before buying. Asking questions helps you understand exactly what you’re getting yourself into. It’s easy to get emotionally attached to a home that’s either priced too high or has too many issues and will be a money trap.

Having some money in the bank after you buy is a great way to help ensure that you’re not in danger of default and foreclosure. It’s the buffer that shows mortgage lenders you can cover upcoming mortgage payments even if your financial situation changes. A good affordability rule of thumb is to have three months of payments, including your housing payment and other monthly debts, in reserve. This will allow you to cover your mortgage payment in case of an unexpected event.

Emerald ash borer found in SW Minnesota county for first time

Perhaps you need to make a budget and a plan to knock out some of your large student or car loans before you apply for a mortgage. Or you wait until you get a raise at work or change jobs to apply for a mortgage. At a minimum, it’s a good idea to be able to make three months’ worth of housing payments out of your reserve, but something like six months would be even better. That way, if you experience a loss of income and need to find a new job, or if you decide to sell your house, you have plenty of time to do so without missing any payments.

With the national median home price above $400,000, according to the National Association of Realtors, $300,000 is a common price point for buyers looking to make the jump from renting to owning. How much you need to make to afford a $300K purchase depends on a number of factors beyond just annual salary, though. Having a trusted real estate agent by your side to help you navigate the homebuying process can make the experience far less stressful. An agent will help you negotiate the most competitive deal possible, ensure that the paperwork is in order and make sure there are no hiccups as you proceed through closing.

Let’s say your car payment, credit card payment and student loan payment add up to $1,050 per month. Your proposed housing payment, then, could be somewhere between 26% and 35% of your income, or $1,820 to $2,450. Having an emergency fund can be a good safety net for anyone, especially new home buyers. APR (%) is a number designed to help you evaluate the total cost of a mortgage.

But you have to follow specific rules about how to give and receive a cash gift. With a few creative steps, you might be able to afford more home than you thought — without waiting to save more cash. Home buyers are feeling the affordability squeeze, with high home prices on one hand and rising rates on the other.

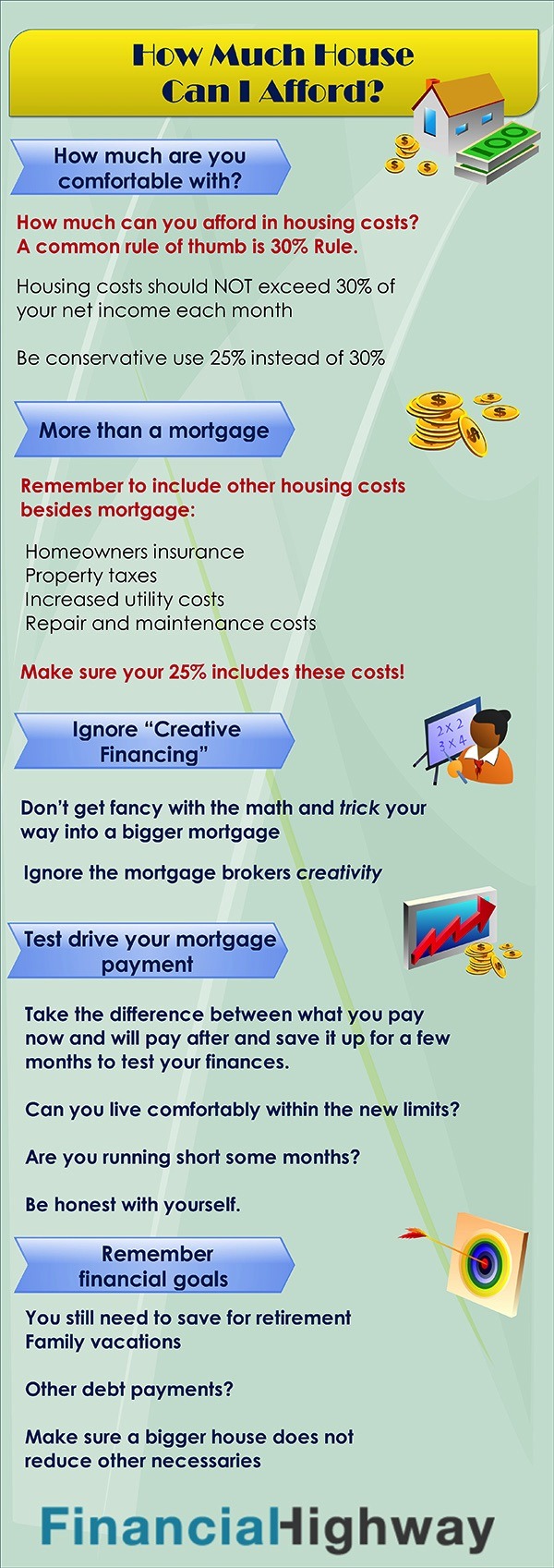

Remember that there are other major financial goals to consider, too, and you want to live within your means. Just because a lender offers you a preapproval for a large amount of money, that doesn’t mean you should spend that much for your home. Most financial experts recommend a maximum housing budget of around one-third of your income — hence the tripling of your housing costs above.

Once you begin the mortgage-application process, you’ll have to wait several weeks or longer for closing day to arrive. During this time, it’s important to remain financially disciplined and not make any major purchases or changes that could impact or decrease your credit profile. Lenders are looking for stability — if you switch jobs or apply for a bunch of new credit cards, for example, they could very well change their mind about approving your loan. Amy Fontinelle is a freelance writer, researcher and editor who brings a journalistic approach to personal finance content. Amy also has extensive experience editing academic papers and articles by professional economists, including eight years as the production manager of an economics journal.

In summary, Los Angeles, CA, is a city with a rich history, diverse geography, and a dynamic economy. It's a place where the entertainment industry meets technology, fashion, and more. The city's political landscape is predominantly Democratic, reflecting its diverse populace. Life in Los Angeles is full of opportunities to explore cultures, cuisines, and outdoor activities, but new residents should be prepared for higher living costs and traffic. Understanding and embracing the unique aspects of Los Angeles can make living in the city a truly rewarding experience.

No comments:

Post a Comment